Driving Successful Lives Has Created a Program for Churches to Increase Attendance for Services and Events

Industry: Non Profit & Charity

The non-profit organization has expanded its community outreach with a new program designed to increase local church attendance

Michigan (PRUnderground) July 29th, 2019

Non-profit fundraiser and community outreach organization, Driving Successful Lives, has recently announced the development of a new program designed to help increase awareness and participation with local churches. The organization detailed the functionality of its tested program – beginning with the White Lake Presbyterian Church in White lake, MI – a working partner with Driving Successful Lives on other community initiatives.

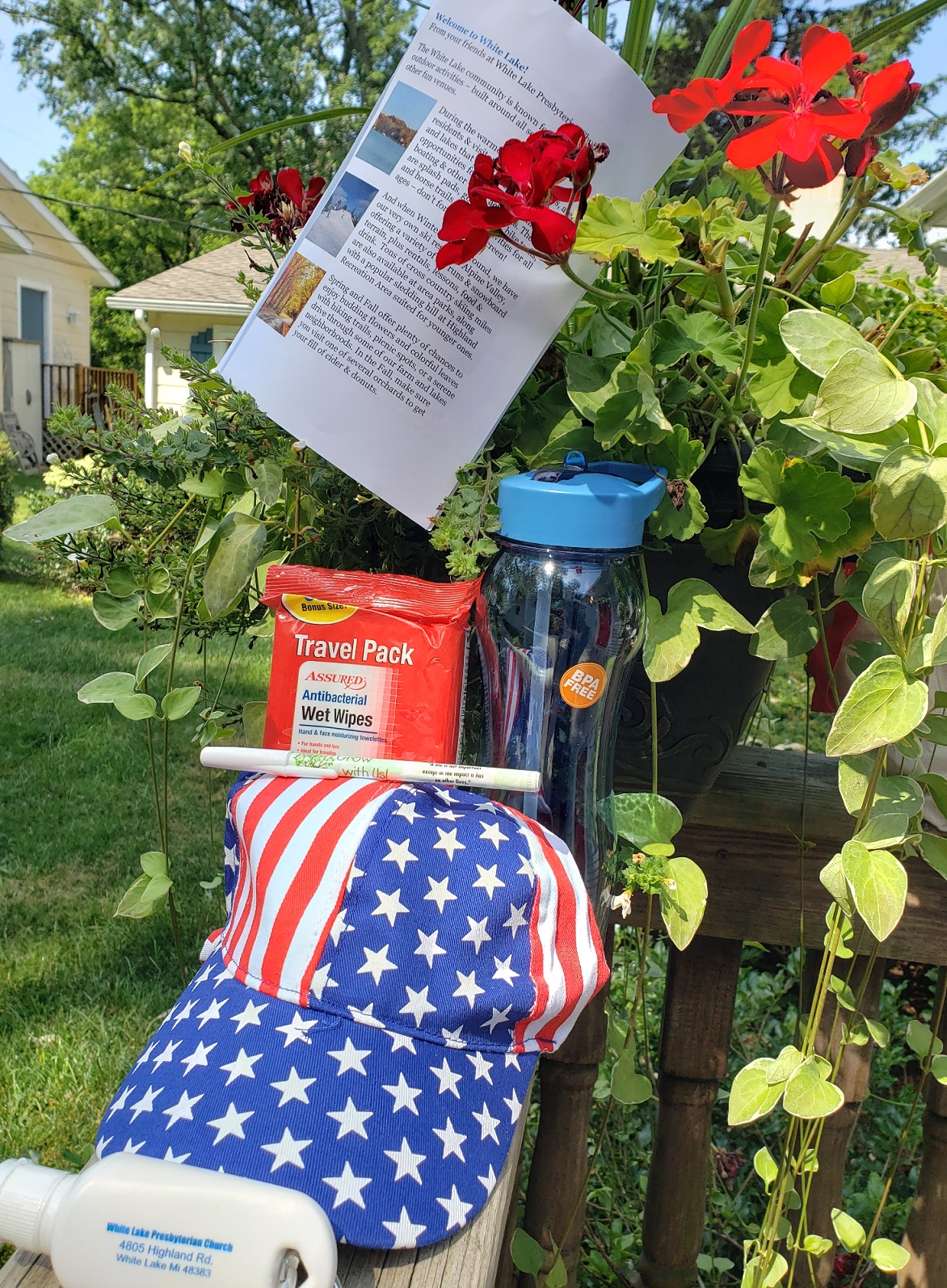

“Our new outreach program is centered on collaboration,” said a spokesperson for DSL. “We reach out to local realtors in the area to find out who the new neighbors are in an area, and we drop off a welcome package for those new residents. The welcome package is a gift bag with information about the area – including things to do, places to go & a variety of interests common to families. We’ve also included a few gifts, such as water bottles, hats, sun block, kites, etc. during the summer and fall. Along with the gifts are welcome letters and invites to attend services at a neighboring church.”

Driving Successful Lives creates and funds the project (on a limited basis) and the program is available across the country. Churches of all denominations are encouraged to connect with DSL for more information – along with a step-by-step instructional on how to make the program work best in their area.

About Driving Successful Lives

Driving Successful Lives’ mission is to help raise funds and improve the lives of veterans, homeless families, children, those with addictions while helping donors generate a tax deduction, often with property or vehicles they might no longer want.

Every time a person gives to the charity of their choice it may also create a tax benefit for them. Car donations, real estate donations or money donated to non-profit institutions throughout the tax year may be tax deductible which means that they could make a positive difference for people while reducing the amount of income taxes they pay. Contributing to charities can be a very convenient way to reduce taxes and help others.